“Q3 Gold Demand: ETFs vs. Jewelry - Seekingalpha.com” |

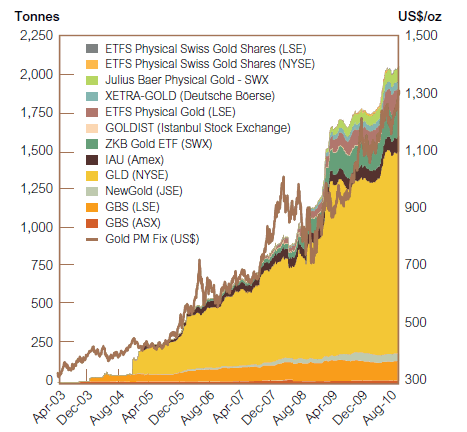

| Q3 Gold Demand: ETFs vs. Jewelry - Seekingalpha.com Posted: 02 Nov 2010 02:19 AM PDT By Julian Murdoch When we last covered the fundamentals of gold supply and demand back in August, we commented that "the third quarter is traditionally (minus 2009) a good one for gold demand ... Perhaps higher demand—and higher prices—lie ahead." For the moment, all evidence points to that trend continuing (albeit at a modest pace). In the third quarter, spot gold rose from $1,242/oz to $1,308. Since then, in just a month, gold has gone up another 4.7 percent to hit a high of $1,369/oz—although prices have since eased off a bit, the rise still suggests an acceleration of demand. But why is gold back on such a tear, and why right now? Clearly, macroeconomic issues are at play; the Fed's inevitable impending round of QE2, not the least among them. But is there more to the story here? Last week, the World Gold Council released its quarterly Gold Investment Digest, providing exactly the under-the-hood look gold investors need. While updated supply and demand numbers won't be published for another few weeks, this investment report usually gives us a sneak preview of what the data dump will contain. ETF Demand Up ... But Barely To see how gold demand has evolved from last quarter, a natural first step is to look at ETF demand, as precious metals ETFs (like GLTR, the new precious metals basket from ETF Securities) make it easier than ever to access the physical space: ETF Gold Holdings

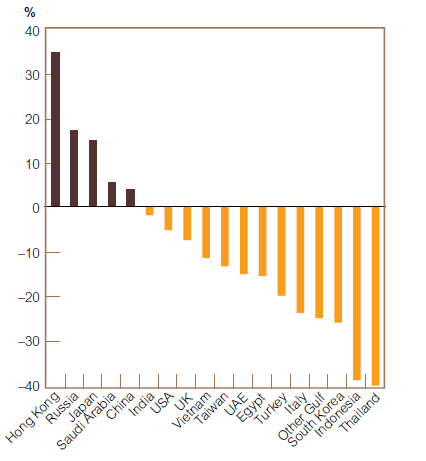

Source: World Gold Council ETF investment may be up, but notice how purchasing flatlined last quarter. This contrasts with previous periods (like Q1 2009), which saw huge spikes in gold purchases from ETFs. But for last quarter, at least, that buying seems to have been quite modest, at 28.3 tonnes (bringing the total ETF holdings to 2,070.1 tonnes at September 30). In fact, it doesn't seem that the October rally has been spurred by ETF demand: Based on our calculations, last month, ETFs worldwide actually sold just under 8 tonnes of gold from their vaults. But gold's rising price must mean demand coming from somewhere. Our bet? Jewelry. Jewelry Demand: Not Just India Anymore Jewelry demand is traditionally a huge driver of gold prices, ranging on either side of 50 percent in any given year or month. And of that demand, India remains king. Considered some of the savviest buyers in the market, Indian consumers drive anywhere from 10 percent (in a bad quarter) to over a third of global jewelry demand. Still, entering the quarter, buying looked a little light in India, with year-over-year demand in the country actually slightly negative. But any slack had been more than made up for by other Asian countries, including Hong Kong, Japan and Russia: Jewelry Demand, Q210 vs. Q209

Source: GMFS While we don't have hard numbers on how exactly the classic September-October pre-festival buying season panned out in India, we do have this nugget from the WGC report:

It's easy to miss the subtlety here. September usually marks the pickup in Indian demand, but a surge doesn't always happen. In 2007, for example, Q3 Indian demand crashed along with the regional economy, while in 2008, Indian buying made a major resurgence ahead of the wedding and festival season. In 2009, the first half of the quarter started weak, as gold prices remained extremely high, but then demand surged in late September and into October. But it's worth noting that while much of the rest of the world's economies are struggling with stagnation, 2010 has been a very good year in India. Its economy has grown at nearly 9 percent, and both inflation and government deficits are under control. For gold bulls, this demand shift away from predominantly U.S. ETFs and back toward jewelry is, I think, a good sign. If gold prices can remain high on the back of declining ETF demand, then should significant QE2-driven inflation fears revive ETF demand again, that would just pile U.S. fear on top of Indian exuberance. In which case, get out of the way of that charging bovine. The caveat, of course, is that ETF demand has proven fickle, and prices remain at all-time record highs. On an inflation-adjusted basis, you'd have to go back to the Carter administration to find prices like this. And remember, back then investors faced a Fed funds target rate of 20 percent, and an inflation rate of 14 percent. If that's enough to temper the bull — well, we just calls 'em like we sees 'em. Disclosure: No positions This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read our FAQ page at fivefilters.org/content-only/faq.php |

| You are subscribed to email updates from wedding jewelry - Bing News To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment